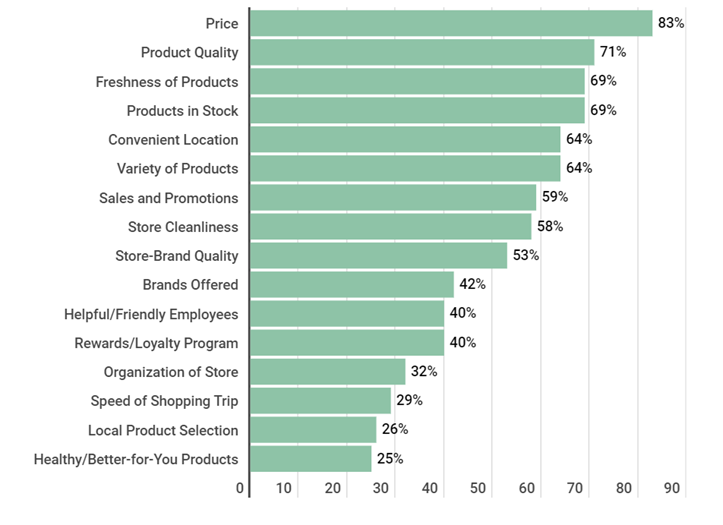

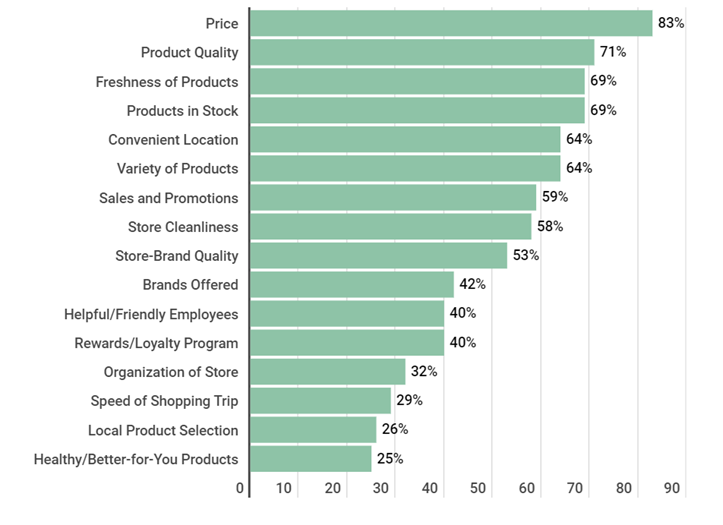

To remain competitive and continue to drive traffic and sales, grocery marketing strategies must adapt to shifting consumer behavior as shoppers respond to rising prices. Grocery stores face continued challenges to drive traffic and sales due to 4 key factors affecting performance.

1. 23.4% Cumulative Grocery Inflation from 2019-231

The cumulative impact of high inflation over the past four years is contributing to sticker shock among grocery shoppers and is having a negative impact on performance.

Grocery shoppers bought less in the past year due to inflation. While product quality/freshness and items available in stock remain important, price has become the No. 1 factor in choosing where to shop2.

2. More Consumers Shop at Walmart for Groceries3

Consumers who shopped Walmart over the past 90-days increased 3 percentage points between 2019-23, as consumers look to the #1 grocer for value in high inflationary times.

Percentage of Consumers Who Shopped at Walmart Past 90 Days3

2019 2023

55.6% 58.7%

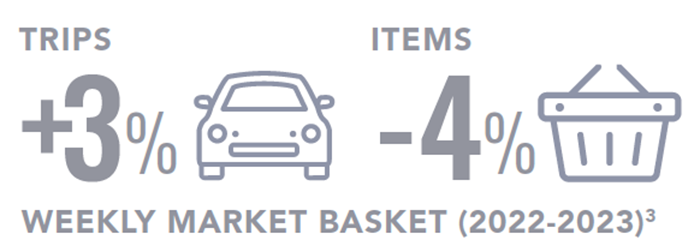

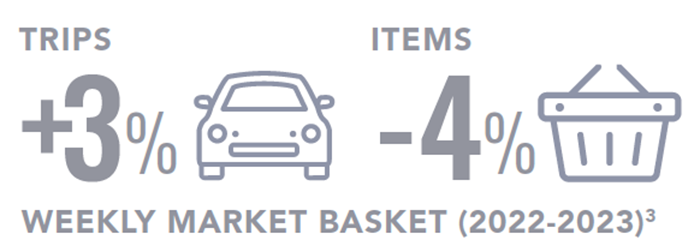

3. Shoppers Make More Trips for Fewer Items from 2022-234

In reaction to rising grocery prices, consumers have increased the frequency of store visits in the past year, while decreasing the number of items in their carts.

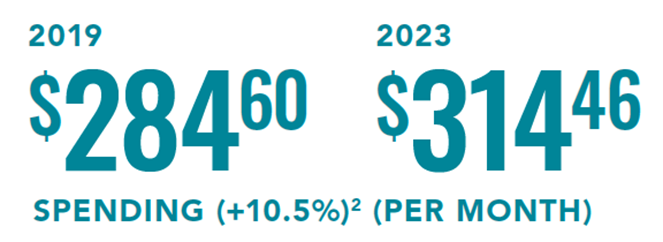

4. 10.5% Increase in Monthly Spend

The average spend for a grocery trip today is $1082 (according to Progressive Grocer consumer expenditures study), and monthly spend increased 10.5% from 2019 to 2023.3

This increase is significantly less than the rate of grocery inflation during the same period, indicating consumers are buying fewer items and prioritizing necessities.

Nearly eight in 10 shoppers admitted that they’ve changed their behavior in some way to cope with inflation.2

- Approximately 40% are either buying fewer impulse items or buying items that are on sale.

- 33% are buying more store brands.

- 32% are using more coupons.

- 23% are buying more in bulk or larger pack sizes.

- 22% are shopping more often at discount grocery stores and buying fewer higher-ticket items, including prepared foods, fresh meat and seafood, and fresh produce.2

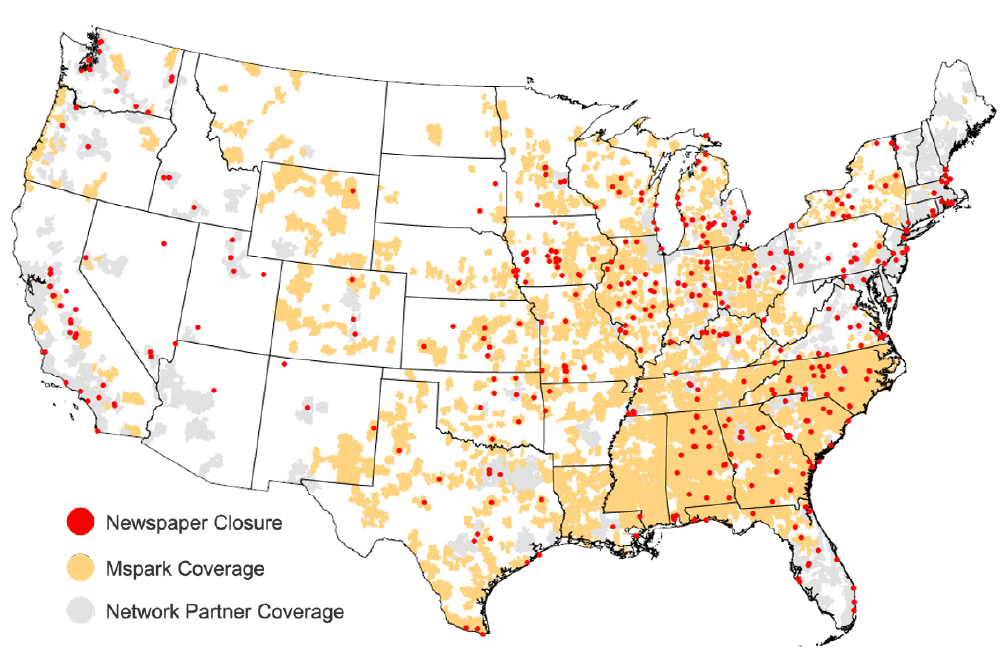

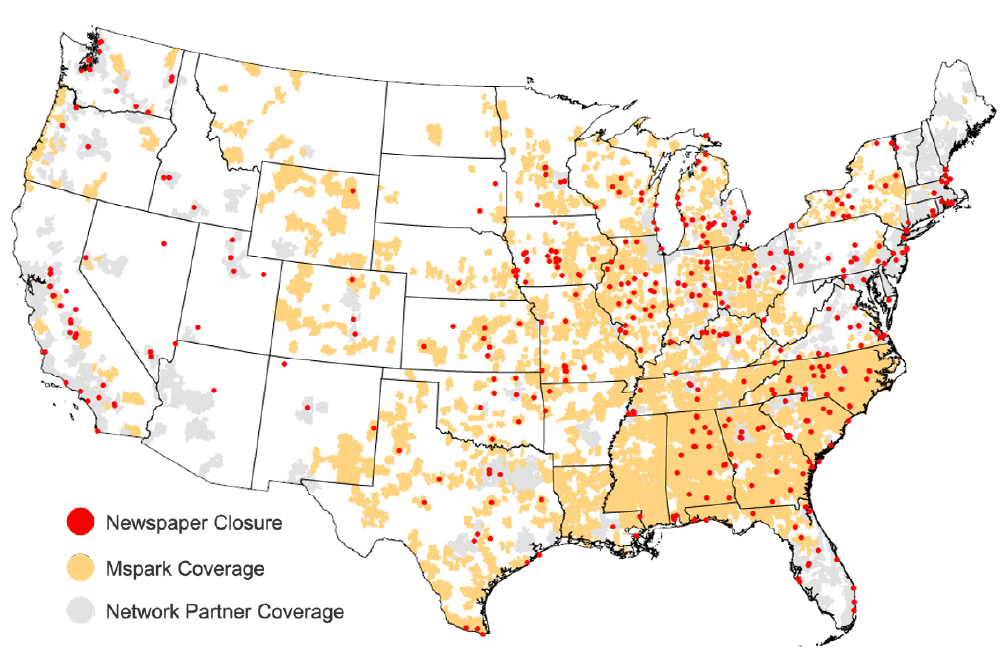

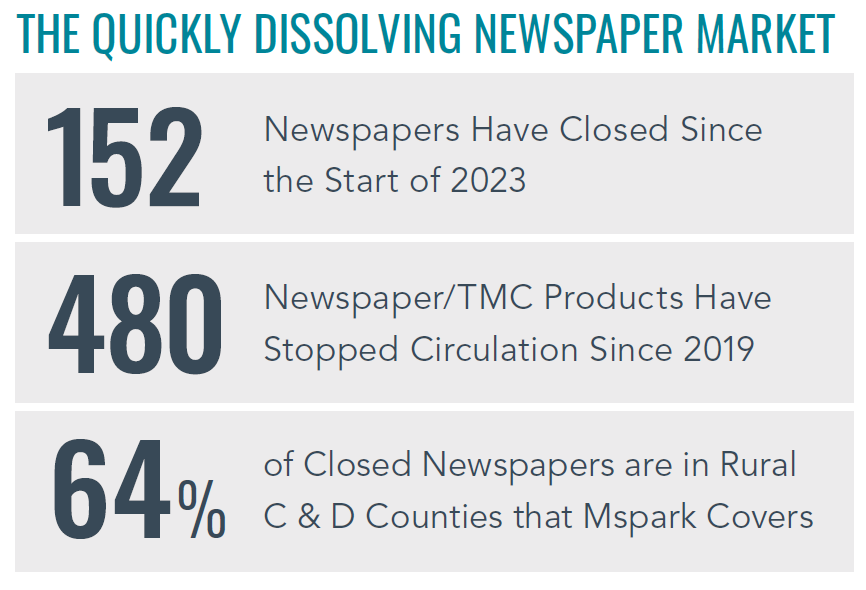

Grocery stores have historically relied on newspaper to place their weekly circulars in shoppers’ hands, but the newspaper market continues to shrink nationwide. Mspark offers coverage in areas where newspapers are no longer available to reach your target grocery shopper.

Drive Sales With Integrated Media

Give your grocery marketing an edge over the competition with an integrated Shared Mail + CTV and Acquisition Email solution.

Build Awareness with CTV

CTV uses proprietary data to identify and target the most relevant zip codes. Campaign performance is improved by reaching the most highly desired audiences based on demographic, viewing habits, conversion activity, and other factors, reaching consumers at the top of the funnel.

- Alternative to Linear TV

- Effective in promoting purchases such as groceries

- Grow upper-funnel awareness (Reach & Frequency)

- Cost effective entry point to CTV

- Accelerate Customer Growth with Equire Acquisition Email

As a stand-alone program or in conjunction with our Shared Mail Circular or Digital Display solutions, Mspark’s Acquisition Email campaigns drive new customer engagement with unmatched efficiency and ROI.

Integrity of the data:

- Most Responsive Email

- True Open Rates

- First-party database

- Cookie-less

- 100% User opt-in

Shared Mail Distribution of Circular Activates Consumers

Consumers are more carefully planning their purchases and looking for value in every transaction. Shared Mail distribution of your circular delivers value in a format that consumers of all generations appreciate and respond to when planning their grocery shopping.

Learn more grocery marketing tips and insights in our blog posts. Click “get started” below to connect with an expert to discuss your marketing goals.

A 2024 Grocery Marketing Strategy That Skips Print Could Cause You to Miss Valuable Customers

New Movers are a Prime Grocery and Pharmacy Marketing Opportunity

Grocery Store Marketing: Strategically Target & Engage Price-Conscious Shoppers

Sources: BLS, Historical Year End CPI – 2019-20231; 75th Consumer Expenditures Study: Taking the Pulse of Shopper Attitudes | Progressive Grocer2; Prosper Insights & Analytics, Monthly Survey – August 2019 and August 20233; McKinsey & Company, Consumers: Spending more to buy less – February 14, 20244