Gallup’s January 2024 monthly economic confidence index—rating consumers’ views on whether the economy is getting better or worse—increased six points over the previous month and is up 14 points since November, the highest level in 2 years.1

The study revealed 63% of U.S. adults say recent price increases have caused financial hardship for their family. Of those, 17% rate the hardship as severe, saying it affects their ability to maintain their standard of living.1

Those in lower-income households (76%) are more likely than those in middle-income households (64%) and higher-income households (54%) to say price increases are causing them hardship.1

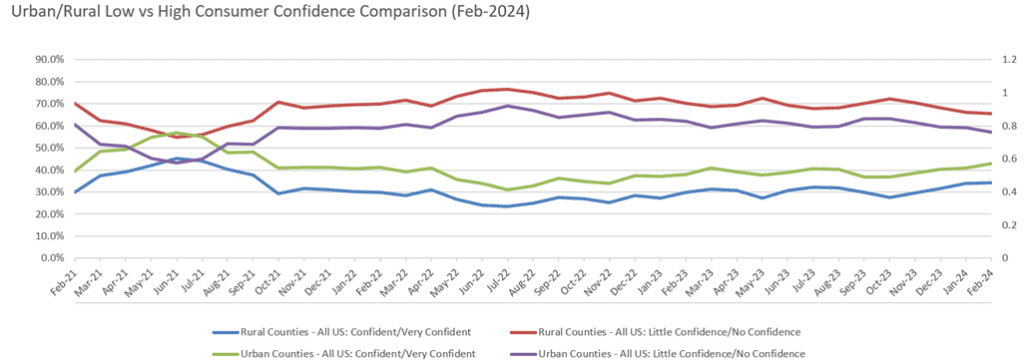

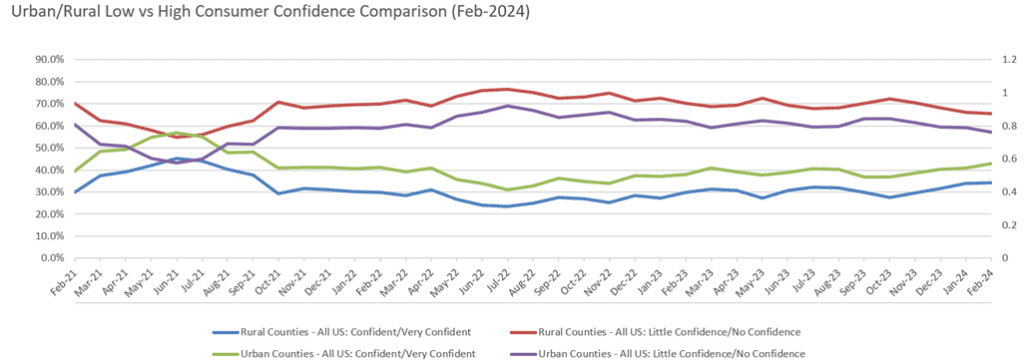

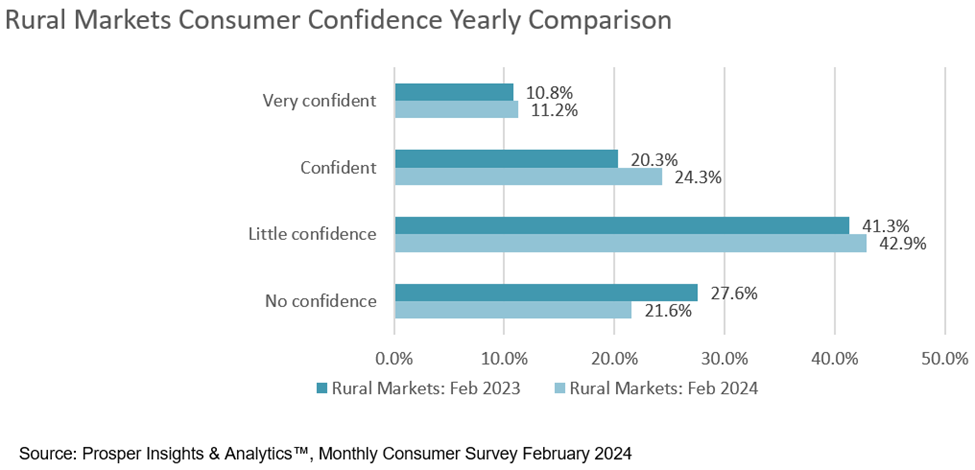

Consumer Confidence is Lower in Rural Markets

In the rural markets Mspark serves, consumer confidence in the economy remains low, 10% lower than urban consumers, according to Prosper Insights & Analytics Monthly consumer survey for February 2024.2

Little to no confidence in the economy:

- Rural consumers: 67%

- Urban consumers: 57%

Confident/very confident in the economy:

- Urban consumers: 43%

- Rural consumers: 33%

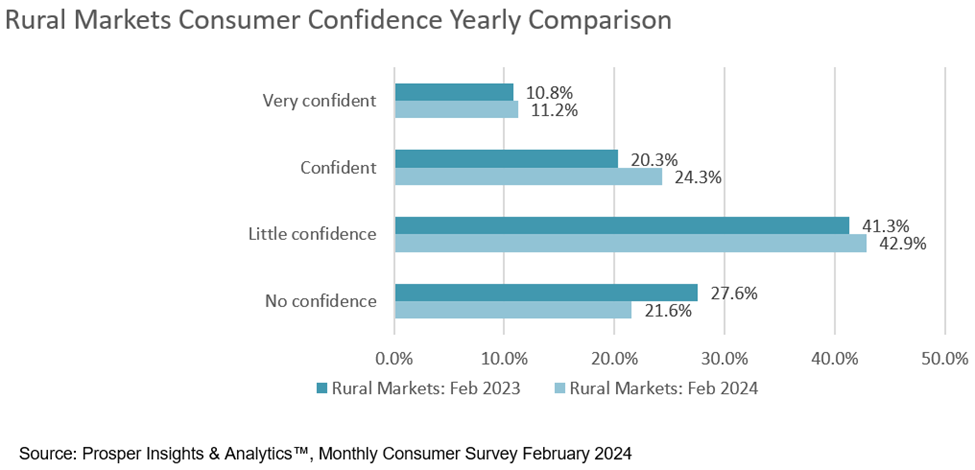

From 2023 to 2024 in rural markets, there has been a small uptick in consumers who are very confident or confident, while consumers with little confidence increased 2.5% and those expressing no confidence decreased 5.3%.2

Simply put, consumers remain uncertain about the economy nationwide, with rural consumers more concerned than urban consumers, and it is causing them to change their spending patterns. A recent Forrester report indicates consumers are already shifting to private-label brands and discount/value retailers like Costco and Aldi. Forrester predicts ongoing economic uncertainty will cause consumers to continue to prioritize value as they make purchase decisions this year.3

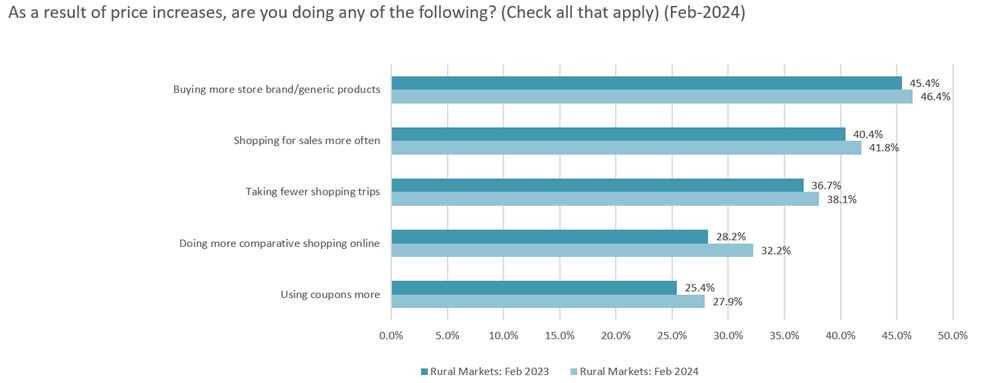

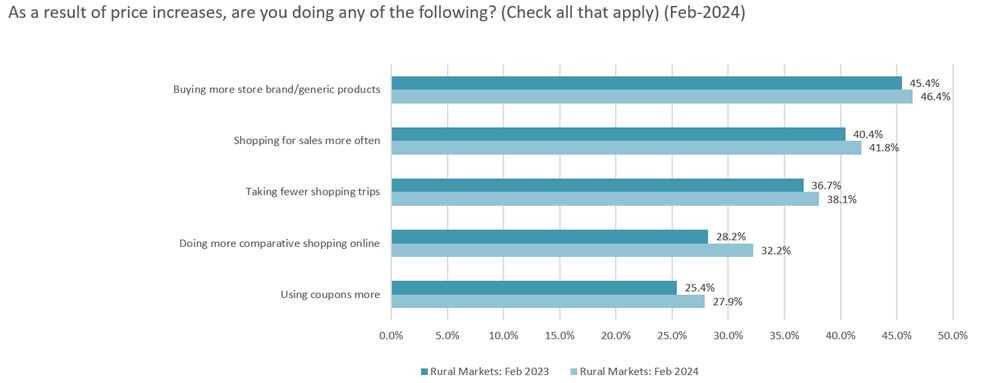

Response to Price Increases in Rural Markets

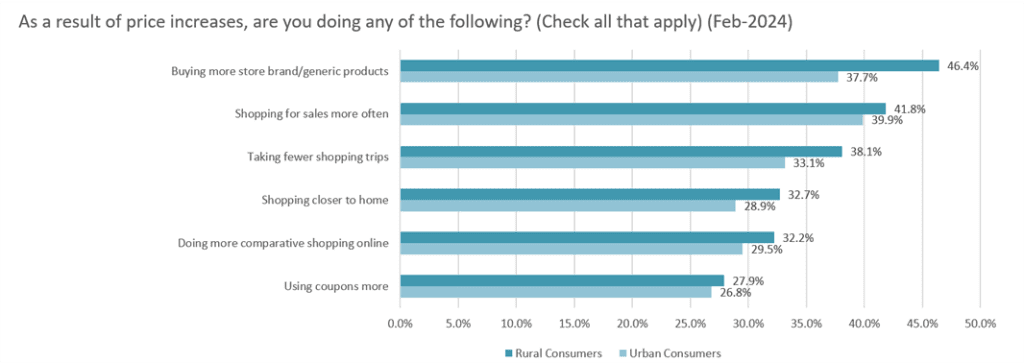

Consumers in rural markets continue to cut costs in a number of ways, buying store brand and generic products, shopping sales, taking fewer shopping trips, doing comparative shopping online, and using coupons more often in 2024 compared to a year ago:2

Expect this value trend to continue in 2024 as most consumers look to get even more out of their spending through a variety of methods, including trials, special offers, bundles, and payment plans.

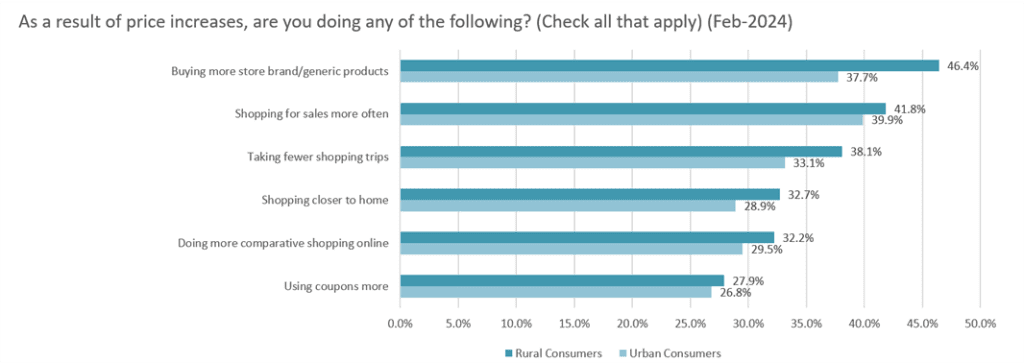

While the value-seeking trend is evident across rural and urban markets nationwide, more consumers in rural markets continue to cut costs in multiple ways compared to urban consumers, including buying more store brand/generic products (8% more).2

Rural consumer vs urban consumer response to price increases comparison:

Target Consumers Seeking Value with a Data-Driven, Personalized Approach

Mspark can help you navigate shifting consumer behavior with a data-driven approach that efficiently targets your highest-value potential customers and engage them with personalized, relevant messaging to meet them wherever they are in the buying process.

Data Analysis and Targeting

Insights gained from data analysis enable us to enhance and optimize your campaigns, connect the right message with the right customer, and make the most of your advertising budget. View our video to learn more.

Coordinated Campaigns

A custom campaign coordinating print and digital messaging across multiple channels can ensure you reach your target audience wherever they are in their buying journey. On average, consistent brand delivery increases revenue by 23%.4

Did you know?

When your campaign messaging is personalized to your customer or prospect, they are 68% more likely to engage with your message.

Learn more about the effectiveness of coordinated print and digital solutions here. Complete the form below to connect with an expert to discuss your customer acquisition goals.5

Sources: Economic Mood Improves but Inflation is Still Vexing Americans, Gallup.com, Jan. 30, 20241; Prosper Insights & Analytics Monthly Consumer Survey January 20242; Consumers Embrace Calm After The Revenge Spending Storm, Forrester.com, Oct. 24, 20233; 3 Reasons Why Brand Consistency Should Be Top Priority advertisingweek.com, 20224; Lob State of Direct Mail Consumer Insights 20235