As inflation stabilizes, restaurant marketing that focuses on value can gain customers who, weary of price increases, will continue to seek deals and savings. 2024 has the potential to be the most “normal” year since the pandemic, the second year of a trajectory that will span multiple years, according to BTIG Managing Director-Restaurants Peter Saleh as reported by QSR magazine.1

Cumulative restaurant inflation soared to 23% over the past 4 years (most in late 2022 and early 2023), averaging nearly 6% a year (2-3% is typical). Inflation suppresses traffic. Overall, restaurant traffic today stands 18.4% lower than before the pandemic1, a deficit that could take 6-9 years to make up at the normal restaurant growth pace of 2-3% annually.

As continued pricing pressures on consumers suppress traffic, restaurant marketing must focus on increased promotions and value offerings to win in the marketplace. Saleh predicts the steepest discounts in four years, with a focus on lower-income consumers who have cut back in recent quarters.

Domino’s Grows While Consistently Delivering Value

Domino’s continues to gain market share by “leveraging scale and tech” to maintain its value offerings. The brand has steadily increased its share of the quick-service pizza category over the past 15 years, from 9% in 2008 to nearly 23% last year1.

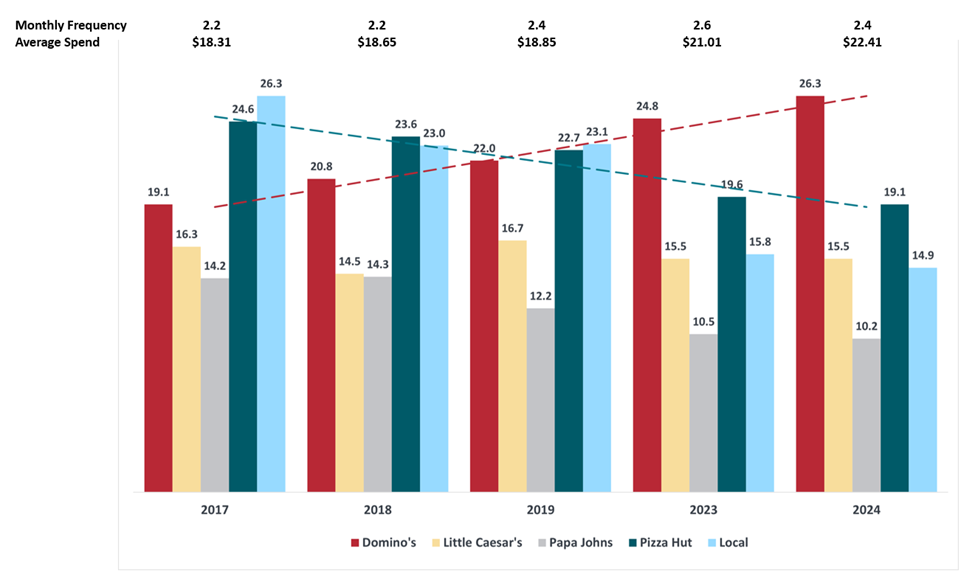

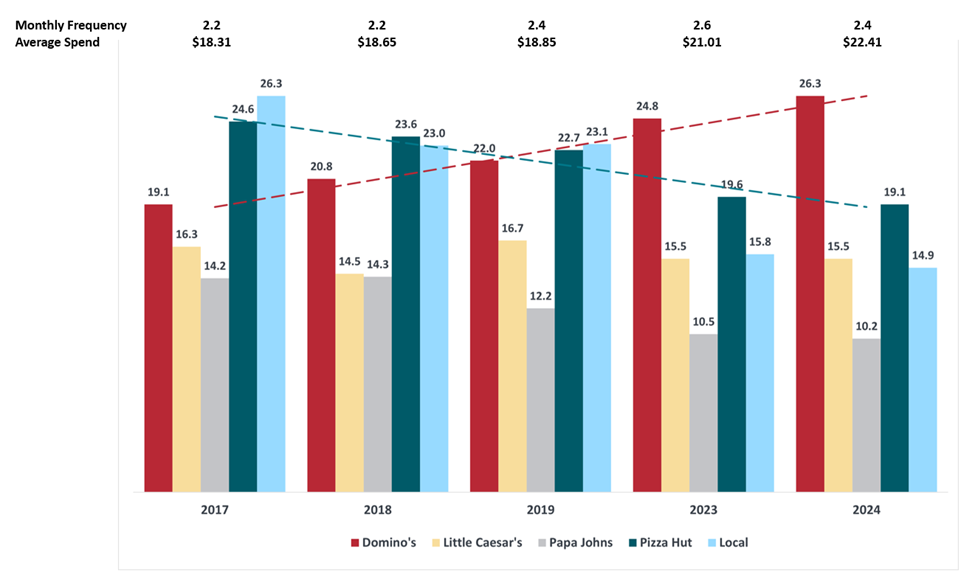

Comparable data from Prosper shows Domino’s pizza share of stomach growing from 19.1% in 2017 to 26.3% in 2024. while all other brands lost share. In particular, Pizza Hut dropped from 24.6 in 2017 to 19.1 in 2024.5

Average monthly frequency within the category grew from 2.2 times per month in 2017 to 2.6 in 2023, before dropping to 2.4 in 2024. Pizza frequency has performed better than restaurants overall, which have seen declines. As expected, average spending per visit grew from $18.31 to $22.41 during this period.5

McDonald’s Looks to Win Back Lower-Income Customers

In the U.S., McDonald’s focus is on reduced transactions by lower-income consumers who make $45,000 and below. CEO Chris Kempczinski noted that these consumers are likely opting to eat at home as grocery/supermarket inflation has cooled faster than food-away-from-home. The company is prioritizing re-engaging these customers this year2.

“The battleground is with the low-income consumer. What you’re going to see is more attention to affordability… Think about that as an absolute price point, which is more important for that consumer to get them into the restaurants than maybe value messaging,” Kempczinski said. “We are set up well to go after that.”

McDonald’s is also leveraging its restaurant marketing capabilities and digital platforms to promote value. Its loyalty program has 150 million+ active members today, nearly 6% of the customer base, who generated over $20 billion in sales in 2023.2

Value offerings give McDonald’s the ability to gain market share from middle- and higher-income households who are trading down from casual dining to save money.

What Restaurants Can Learn from Domino’s & McDonald’s Value Offerings

By developing a restaurant marketing strategy that prioritizes consistent value offerings, restaurants can acquire new customers and increase growth year over year.

No. 1: Target your best audience and engage them with value-focused messaging.

- 25% of restaurant customers choose where to dine based on a coupon.3

- 61% of consumers surveyed said rising prices are causing them to be less brand loyal.4

No. 2: Reach the rural consumer. Rural consumers are more sensitive to inflation and respond to price increases differently.

- Rural consumers are more likely to reduce driving and shopping trips to save on gasoline and to plan their shopping and purchases ahead of time.5

- The planned bundling of shopping trips increases the need for longer value and deal shelf life, which affects the message and the choice of media. 5

No. 3: Ease the sticker shock of rising prices and create preference by offering value.

- Nearly 50% of rural consumers surveyed said they shop online for lower prices, and nearly 40% shop online to find better sales and deals.5

Customized Solutions to Help Restaurants Achieve Their Goals

Gain market share and expand your reach with highly visible, cost-effective saturation print that enables you to reach an entire market or zone at minimal cost.

- 69% of consumers surveyed tried a new restaurant after receiving marketing mail.6

- 74% of marketers say direct mail delivers the highest response, conversion rate, and ROI of any channel used.7

Multi-channel restaurant marketing campaigns ensure consistent delivery of your message across media channels. For restaurant diners in the rural markets Mspark serves, 64% of media influence on dining-out purchases comes from print and digital channels combined.5

A digital solution that achieves the broad reach ideal for restaurant and QSR advertisers to efficiently target their ideal customers is Connected TV (CTV).

CTV advertising is delivered to consumers through internet-connected television such as smart TVs, gaming consoles or streaming devices.

Did you know?

87% of US adults own at least one connected TV, and almost half of US adults watch a connected TV daily.8 With CTV, advertisers can reach consumers streaming on all screens down to the household level with:

- Non-skippable inventory

- Ability to exclude linear TV subscribers from addressable campaigns

- Average video completion rate of 98%

Mspark recognizes there is no one recipe for success; every solution is customized for each client. Download our restaurant marketing eBook for more insights to inform your restaurant marketing strategy for 2024. Complete the form below to connect with an expert to discuss your goals.

Sources: qsrmagazine.com, “Restaurants Brace for the Most ‘Normal’ Year Since 2019,” December 20231; nrn.com, “McDonald’s CEO: ‘The battleground is with the low-income consumer’,” February 20242; Vericast Restaurant Trendwatch Report 20233; Vericast Awareness to Action Study4; Prosper Insights & Analytics 20235; USPS Mail Moments 20236; Porch/Lob 20237; The Streamable8